E-cigarettes have gained popularity worldwide as an alternative to traditional smoking. When considering importing e-cigarettes into Malta, understanding the rules and regulations surrounding these products is crucial. Malta has its own set of import regulations that comply with EU directives, designed to control the circulation of e-cigarettes and ensure consumer safety. This article delves into the essential aspects of Malta’s e-cigarette import rules, offering insight into registration processes, taxation, and labeling requirements.

To begin with, any entity seeking to import e-cigarettes into Malta must be aware of certain preliminary requirements. Importers must register with Maltese authorities to obtain the necessary permits. In accordance with European Union regulations, Malta mandates that detailed product information be submitted, including e-liquid components and potential health implications.

Registration and Compliance

Compliance with Malta’s import rules is imperative for businesses aiming to enter the e-cigarette market. Entities must ensure that all e-cigarette products meet established health and safety standards. This involves rigorous testing for harmful substances as outlined by EU regulations and Maltese standards, emphasizing consumer protection.

Compliance with Malta’s import rules is imperative for businesses aiming to enter the e-cigarette market. Entities must ensure that all e-cigarette products meet established health and safety standards. This involves rigorous testing for harmful substances as outlined by EU regulations and Maltese standards, emphasizing consumer protection.

From a legal standpoint, the import of e-cigarettes without due compliance may lead to sanctions or prohibitions. Importers are obligated to adhere to guidelines which necessitate thorough inspection and certification of products.

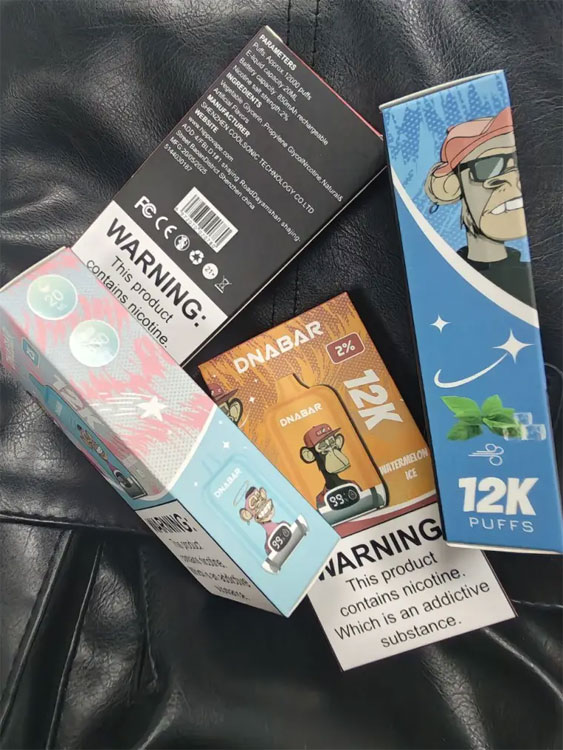

Furthermore, Malta’s regulations require specified labeling on e-cigarette packaging. Labels must include health warnings, ingredients, and manufacturer details, adhering to transparency and consumer awareness policies. These regulations align with EU standards to ensure consistent consumer information across all member nations.

Taxation and Customs Duties

E-cigarette importers in Malta must contend with applicable taxation and customs duties, which may vary depending on the product’s classification. Import duties are calculated based on the item’s value, type, and country of origin, necessitating accurate documentation during import procedures. Understanding Malta’s fiscal policies regarding e-cigarette imports can prevent potential financial pitfalls and ensure smooth operations.

Additionally, a value-added tax (VAT) is applied to e-cigarette products, aligning with Malta’s taxation guidelines. Importers should be prepared for these additional costs and factor them into their pricing strategies.

This comprehensive understanding of regulatory and fiscal requirements aids in navigating the complexities of importing e-cigarettes into Malta. Businesses must stay updated on any changes in legislation or policies that might affect the import process.

Frequently Asked Questions

What documents are required to import e-cigarettes into Malta?

Importers need to provide registration certificates, product specifications, and compliance certifications with EU standards.

Is there a limit on the import quantity of e-cigarettes?

While Malta does not stipulate a strict limit, import volumes should comply with market demand and regulatory guidelines to avoid potential legal issues.